Investing your money is one of the smartest moves you can make to secure your financial future. Whether you want to build wealth, retire comfortably, save for a home, or simply beat inflation, learning how to invest money wisely is essential.

If you’ve ever thought, “How do I even start investing?” — you’re not alone. Many beginners feel overwhelmed by terms like stocks, bonds, ETFs, risk tolerance, and portfolios. But here’s the good news: investing doesn’t have to be complicated.

In this guide, we’ll break down everything you need to know — step by step — to confidently start investing and make your money work for you.

Why Should You Invest?

Before we dive into the how, let’s answer the big question: why bother investing at all? Why not just save your money in a bank account?

Here are a few reasons why investing is better than just saving:

Beat Inflation

Inflation slowly eats away the purchasing power of your money over time. If your money just sits in a savings account earning 1% interest while inflation is at 3%, you’re losing money in real terms. Investing can help your money grow faster than inflation.

Build Wealth

Investing lets your money grow through compound interest. Over decades, even modest investments can grow into substantial sums thanks to the power of compounding.

Achieve Your Goals

Whether it’s buying a house, paying for your child’s education, traveling the world, or retiring early — investing gives you the means to reach your dreams.

How to Invest Money: Step-by-Step

Here’s a simple, actionable roadmap for how to invest your money wisely.

Step 1: Set Clear Financial Goals

Before you start investing, ask yourself:

- What am I investing for? (retirement, house, education, etc.)

- When will I need the money? (short-term vs. long-term)

- How much risk am I comfortable taking?

Knowing your goals and time horizon helps determine the right investments for you.

Step 2: Build an Emergency Fund

Before you put your money into investments that can fluctuate in value, make sure you have an emergency fund — ideally 3–6 months’ worth of living expenses — in a safe, accessible place (like a savings account).

This fund is your safety net and ensures you won’t have to pull out your investments in a market downturn.

Step 3: Understand the Different Investment Options

Here are the most common investment vehicles:

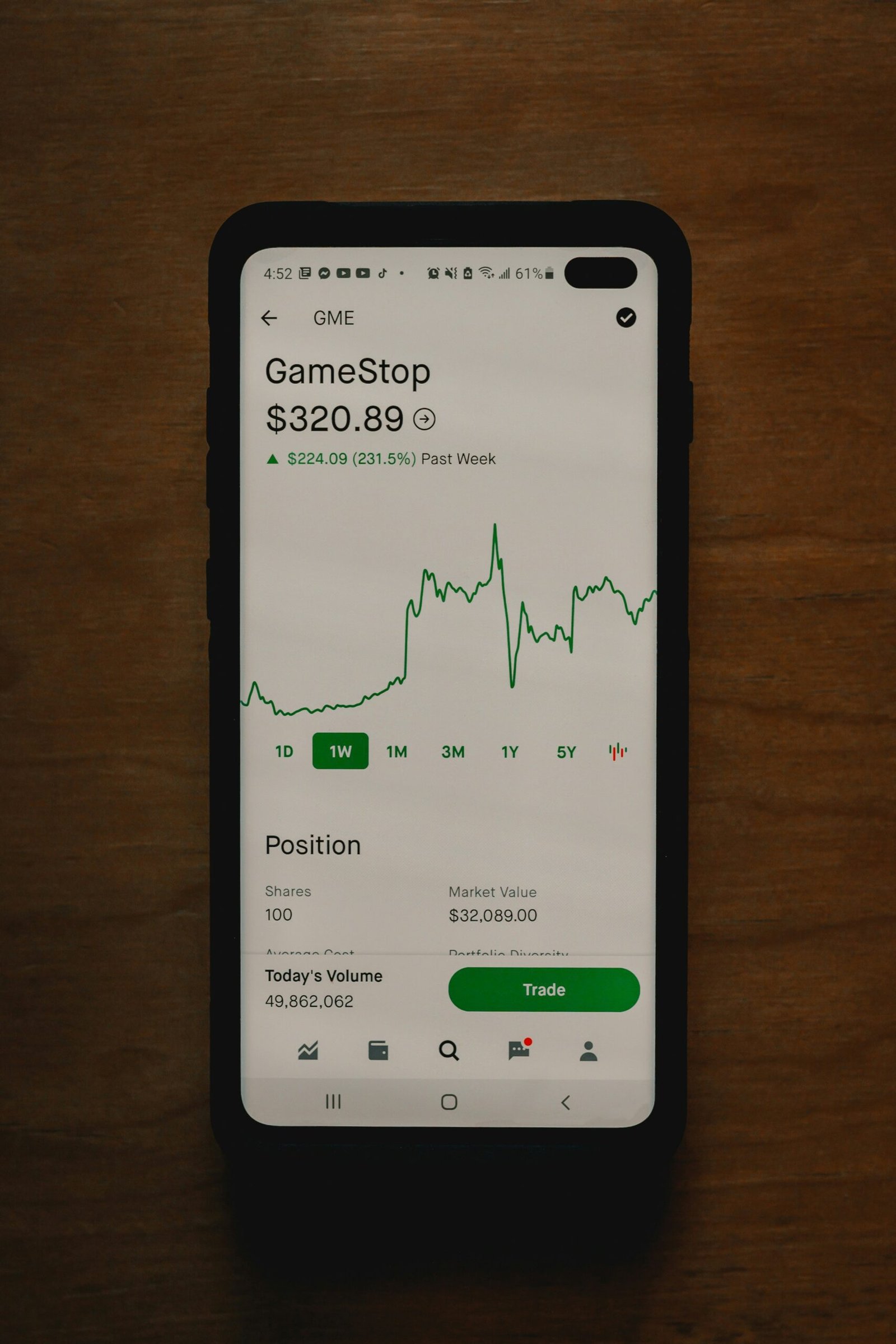

Stocks

- Owning a share of a company.

- High potential returns but higher risk.

- Best for long-term investors.

Bonds

- Lending money to a company or government in exchange for regular interest payments.

- Lower risk than stocks but lower returns.

Real Estate

- Investing in property — either directly or via real estate investment trusts (REITs).

- Can generate rental income and appreciate over time.

Mutual Funds & ETFs

- Pools of money from many investors that are managed by professionals.

- Offer instant diversification, which lowers your risk.

- ETFs (exchange-traded funds) are like mutual funds but traded on stock exchanges.

Other Assets

- Commodities like gold, silver.

- Cryptocurrencies.

- Collectibles or alternative investments.

Step 4: Know Your Risk Tolerance

Everyone has a different comfort level with risk.

If you can’t sleep at night because your stocks dropped 10%, you might want a more conservative portfolio.

Generally:

- Younger investors can take more risk because they have time to recover.

- Older investors nearing retirement should prioritize stability and income.

Step 5: Choose an Investment Account

You can’t just walk into a store and buy stocks. You need to open an investment account.

Some options:

- Brokerage Account: Standard account for buying/selling investments.

- Retirement Accounts: Like an IRA or 401(k) in the US, which have tax advantages.

- Robo-Advisors: Automated platforms that build and manage a portfolio for you.

Step 6: Start Investing (Even Small Amounts)

You don’t need thousands of dollars to start. Many platforms allow you to start with as little as $50–$100.

Some tips:

Automate your investments every month.

Don’t try to time the market — consistency wins.

Focus on the long-term and avoid panic selling.

Popular Investing Strategies

Now that you know how to start, let’s talk about strategies to grow your wealth.

Buy and Hold

This means buying investments and holding them for years or decades, riding out short-term volatility.

Dollar-Cost Averaging

Invest a fixed amount of money at regular intervals (e.g., $200/month). This reduces the impact of market fluctuations.

Growth vs. Value Investing

- Growth investors look for companies that are expanding rapidly.

- Value investors look for undervalued stocks that may be overlooked.

Diversification

Don’t put all your eggs in one basket. Spread your investments across different assets, sectors, and geographies.

Common Mistakes to Avoid

Even seasoned investors make mistakes. Here are a few to watch out for:

Trying to time the market.

Putting all your money into one stock.

Letting emotions drive your decisions.

Ignoring fees and taxes.

Not reviewing your portfolio periodically.

How Much Should You Invest?

It depends on your income, expenses, and goals.

Many experts recommend the 50/30/20 rule:

- 50% of income for needs.

- 30% for wants.

- 20% for savings & investments.

If possible, aim to invest at least 10–15% of your income every month.

Tools & Resources for Investors

Here are some tools that can help you on your journey:

- Budgeting Apps — Mint, YNAB.

- Brokerage Platforms — Fidelity, Vanguard, Robinhood.

- Robo-Advisors — Betterment, Wealthfront.

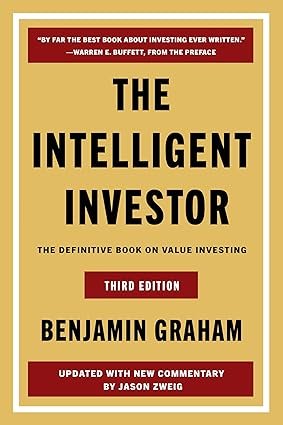

- Educational Resources — Investopedia, books like The Intelligent Investor by Benjamin Graham.

Investing in Different Stages of Life

Your investment strategy should evolve as you age.

In Your 20s & 30s:

- Take advantage of compounding.

- Focus on growth-oriented investments like stocks.

- Build good financial habits early.

In Your 40s & 50s:

- Shift to a more balanced portfolio.

- Increase contributions to retirement accounts.

In Your 60s & Beyond:

- Focus on preserving wealth and generating income.

- Hold more bonds and cash equivalents.

- Plan for healthcare and estate planning.

The Psychological Side of Investing

Investing isn’t just about numbers; it’s also about mindset.

Patience, discipline, and emotional control are crucial.

Here are a few tips:

- Avoid checking your portfolio every day.

- Stick to your plan during market downturns.

- Celebrate progress, no matter how small.

FAQs About Investing

Do I need a lot of money to start?

No — many platforms let you start with as little as $50–$100.

Is investing risky?

Yes, but not investing is risky too. A diversified, long-term strategy helps reduce risk.

What if the market crashes?

Markets are cyclical. Stay invested, and avoid panic selling.

Should I pay off debt before investing?

If you have high-interest debt (like credit cards), pay that off first. Otherwise, you can do both.

Final Thoughts: Start Today

The best time to start investing was yesterday. The second-best time is today.

Even if you can only invest a little right now, starting early gives you a big advantage thanks to compound growth. Take small, consistent steps — and your future self will thank you.

Top 7 Side Hustles To Make Your First Million

How to Earn Online for Students With zero investment (Beginner-Friendly Guide)

Money Management for Students: A Practical Guide to Take Control of Your Finances